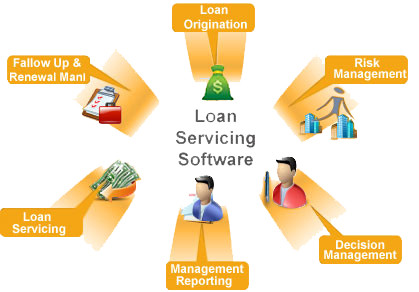

With NBFC loan servicing and processing software manage all loan servicing activities for any type of loan, including conservative, profit-making, production, arms, and appearance of Credit. Its ease of use and deep feature set software ensure an excellent fit for lenders everywhere. The software functions as a complete loan servicing system, collection management, investor participation, escrow accountings, credit reporting, and even electronic funds and collections. But its customizability is perhaps its most significant feature. With this software can easily access investors loan accounting data, alter reports and generate personal relations to suit your unique business needs.

From the instant a loan is funded, NBFC loan servicing software handles every feature by track payments, collection activities, and escrow collection and investor expenditure. And regardless of whether the loan ends in final payoff, is released to another service, or is a fortune in the secondary market, control every detail of clients with loan servicing software. It’s a flexible, powerful and simple to use application module will help to manage large loan servicing processes in a short time. Contact NBFCSoftware today to learn more about loan servicing software suite! Our loan servicing software provides complete automation and seamless data flow for every aspect of loan servicing, we are providing the most cost-effective and efficient software solution on the market today.

Basic Loan Servicing Software Activities: Members Management, Branch Management, Collection Management, Adjustable Rate Mortgages (ARMs)., Escrow and Impound / Tax and Insurance Accounting., Investor Participation, Tracking, Reporting and Servicing., Automatic Task and Report Scheduling., Commercial Loan Servicing, Automobile Loan Servicing and Dealer Reserves and more.

Copyright © 2014 NBFC Software. All Rights Reserved

Powered by Cyrus Technoedge Solutions Pvt. Ltd.